The Hookup Critic

Your go-to source for honest reviews and tips on dating and relationships.

Marketplace Liquidity Models: Navigating the Sea of Supply and Demand

Dive into the world of marketplace liquidity models and discover how to balance supply and demand for success. Unlock the secrets now!

Understanding Marketplace Liquidity: A Comprehensive Overview

Marketplace liquidity refers to the ease with which assets can be bought or sold in a marketplace without causing significant price fluctuations. Understanding marketplace liquidity is crucial for investors and traders as it directly impacts their ability to enter or exit positions timely. A more liquid market typically has a higher volume of transactions and offers tighter bid-ask spreads, making it easier for participants to acquire or dispose of assets. In contrast, illiquid markets present challenges, such as wider spreads and potential price manipulation, which can lead to unfavorable trading conditions.

To assess marketplace liquidity, several factors come into play, including trading volume, the number of active participants, and the frequency of transactions. Investors should consider metrics such as the liquidity ratio and the order book depth to gauge market health. Moreover, understanding different asset classes—such as stocks, bonds, and cryptocurrencies—can provide further insights into how liquidity varies across platforms. By having a solid grasp of these concepts, traders can improve their strategies and achieve better outcomes in their trading endeavors.

Counter-Strike is a tactical first-person shooter game that has captivated millions of players worldwide. The game pits two teams against each other: the Terrorists and the Counter-Terrorists. To enhance your gameplay experience, you can use a daddyskins promo code for exclusive in-game items and skins.

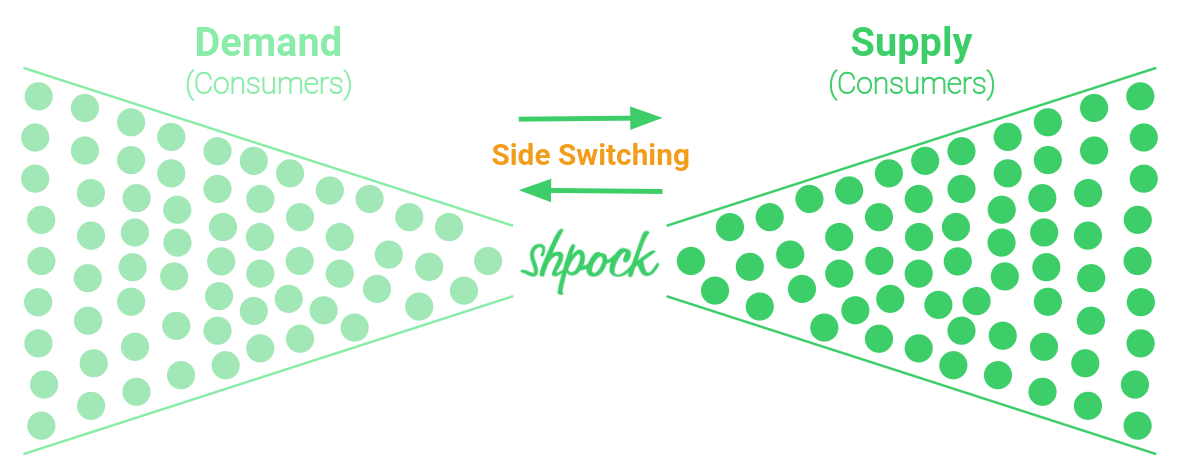

The Impact of Supply and Demand on Marketplace Efficiency

The dynamics of supply and demand play a crucial role in determining the efficiency of a marketplace. When the demand for a product exceeds its supply, prices tend to rise, prompting producers to increase their output. This reaction helps to restore equilibrium, ensuring that resources are allocated effectively. Conversely, when supply outstrips demand, prices may fall, encouraging consumers to purchase more or producers to cut back on production. This responsive behavior of both suppliers and consumers fosters a more balanced market, ultimately enhancing its efficiency.

In a well-functioning market, the interplay between supply and demand not only affects prices but also influences innovation and competition. Businesses are incentivized to improve their products or diversify their offerings in response to consumer needs. Additionally, as competition increases, companies are pushed to optimize their operations, further enhancing market efficiency. In summary, understanding the impact of supply and demand is essential for recognizing how marketplaces operate and evolve, driving both economic growth and consumer satisfaction.

How to Optimize Your Listings for Better Liquidity in Online Marketplaces

Optimizing your listings for better liquidity in online marketplaces is essential for attracting potential buyers and enhancing your sales performance. To start, ensure that you write compelling titles that contain relevant keywords. This helps improve your listing's visibility in search results. Additionally, it's crucial to provide a thorough description of your item, including its features, benefits, and any relevant specifications. Consider using bullet points to highlight key information and make it easier for buyers to digest.

Another significant aspect of optimization is incorporating high-quality images. Ensure your photos are clear, well-lit, and showcase the product from multiple angles. Listings with professional images tend to garner more attention and can lead to increased conversions. Finally, pricing strategically is vital; research similar items in your niche to set a competitive price that reflects the value of your listing. By implementing these strategies, you can greatly improve the liquidity of your listings in online marketplaces.